Today we look at the price movement of Bitcoin from September 19th 2022 and try to utilize the teachings of ICT (Inner Circle Trader) to look for setups in the price movement. If you don't know about ICT make sure to check him out here.

Be aware, that these trade setup reviews are for learning purposes only to help you (and myself) utilize the teachings of ICT in the crypto space. Further it is possible that there are other setups in the chart, which I do not cover, as they might be not clean enough or on a too low timeframe (or I just missed them). Additionally I review the charts by utilizing ICT's teachings how I understood them - please keep in mind, that I could have understood his teachings incorrectly and therefore it is critical, that you watch his content and confirm these setups for yourself.

Before we get into the setups, just have a look at the economic calendar (i use ForexFactory) for September 19th 2022 below. As you can see there are no high impact news events for USD (high (and some medium) impact news events are utilized by smart money and therefore influence price) meaning we do not have to pay attention to news events for September 19th 2022 and can soley focus on the price action.

Setups

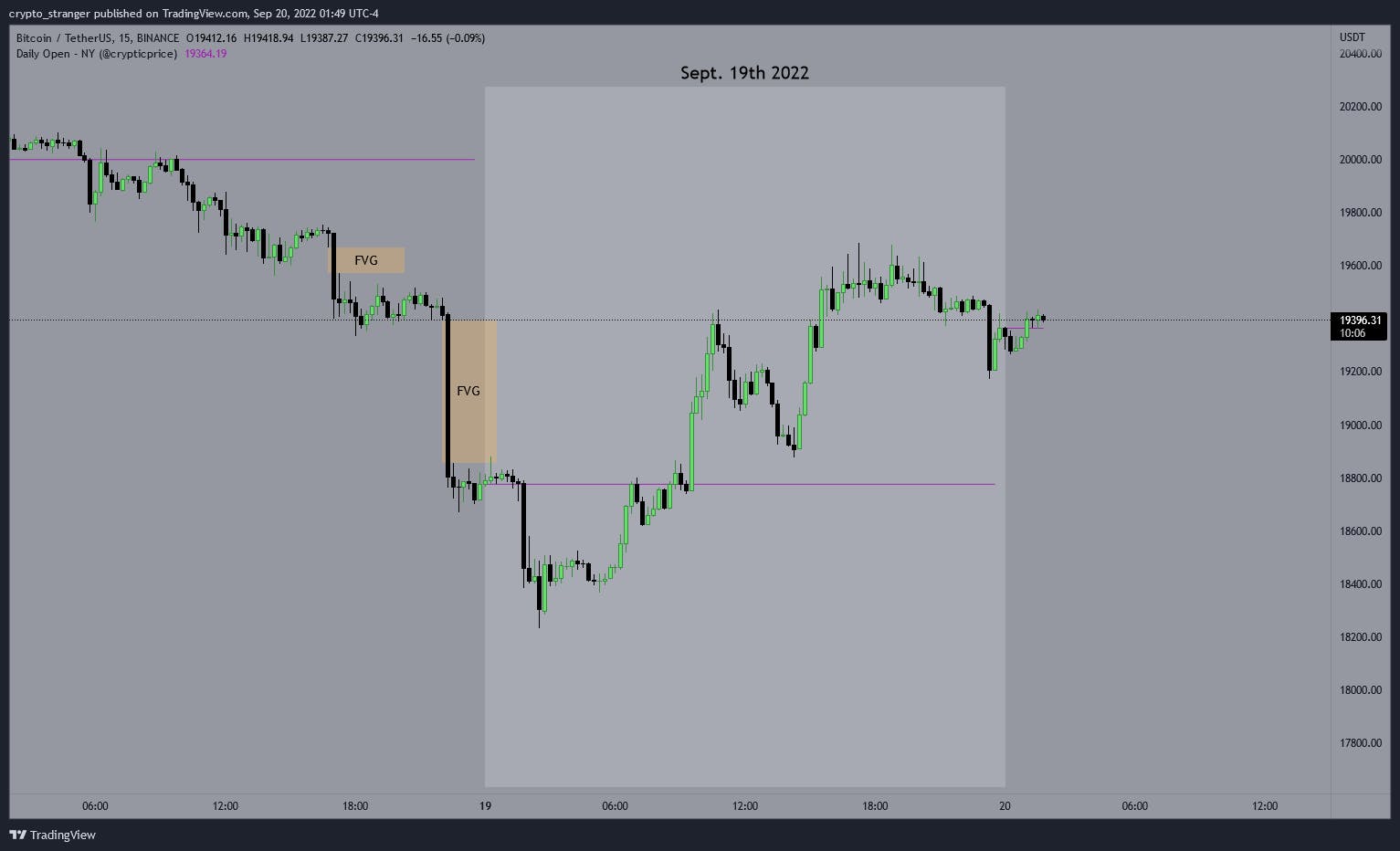

Let's start out by looking at the plain chart.

I highlighted the price movement with a brighter rectangle than the background. Further I have an indicator showing the daily open price according to New York Time (The daily open according to NY-Time is quite important in ICT's teachings). Immediately we can see, that yesterday's price action created 2 big FVG's (Fair Value Gaps). If you do not know what a Fair Value Gap is - have a look at ICT's teachings on his YouTube Channel. These 2 FVG's are going to play a part in the setups we are going to cover now.

1st Setup

The first setup occured in the morning session and the entry for the setup occured just before the market open at 9:30am. Price broke a previous high (7am High) and with this moved above the Daily open (highlighted as purple line). This move above the Daily Open left behind a FVG and by applying the Fib-Tool we can see, that this FVG resides in a Discount. Further we have Liquidity very close above and when price comes that close to Liquidity it tends to take it i.e. we expect price to move up and take this liquidity meaning we are bullish. So for this setup one could have entered the trade once price moved into a Discount in the FVG. The first target could have been the old high - here marked as Liquidity - and then one could have held a part of the position until price reached the big FVG above.

2nd Setup

The second setup occured after lunch. Price took out the pre-lunch Low, which formed at 11:45 and dipped into a Discount right into a FVG and close to the Daily open. Further we have Liquidity closely above (old high + FVG) and similar to the morning setup price tends to run Liqidity it is very close to. So again our bias is bullish. The bullish bias together with price taking out the pre-lunch low and dipping into a FVG in a Discount make for a good trade setup. Additionally price dropped exactly into the OTE (Optimal Trade Entry) area (.618 - .786) as displayed in the chart below, which further supports the setup. Targets for this setup could have been the old High and FVG above.

The 2 reviewed setups are good examples of how to utilize ICT's teachings in Bitcoin. If you have any further insight or if you see another good trade setup on the charts, feel free to leave a comment. Also, constructive critisism is always welcome. I hope you have a productive day and I see you again in the charts!